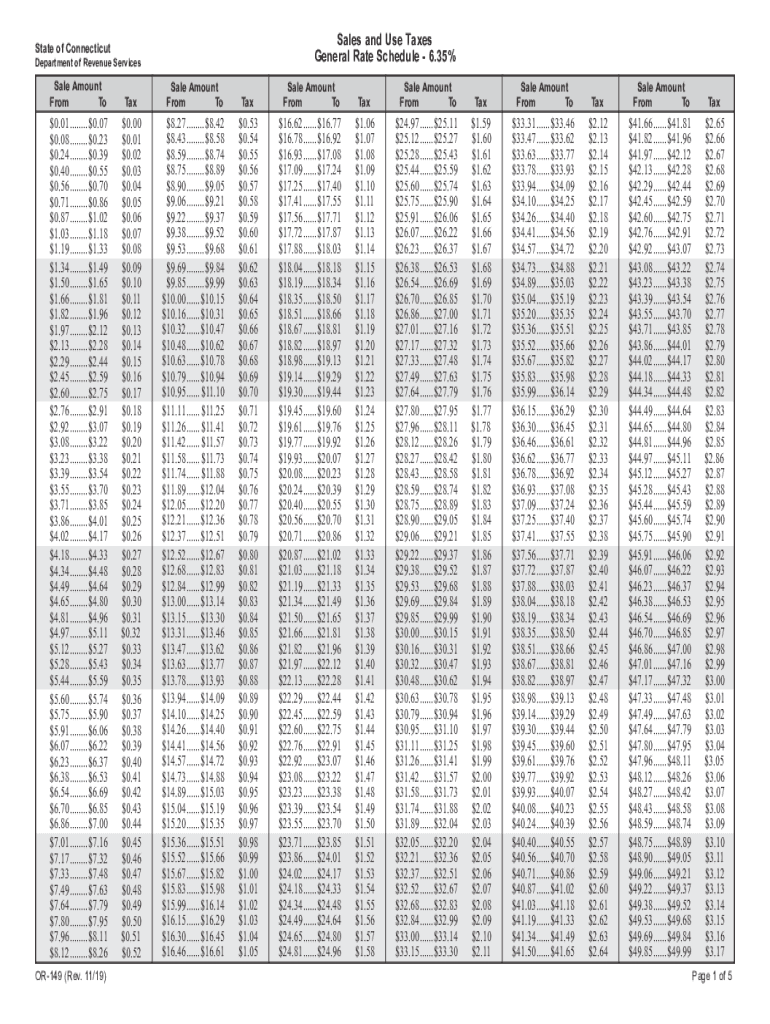

The changes enacted in 2024 will see a decrease in the two lowest rates: Please consider an electronic option to file your state income tax return this year.

Learn more on turbotax’s website if you make $70,000 a year living in connecticut you will be taxed $10,235. This page has the latest connecticut brackets and tax rates, plus a connecticut income.

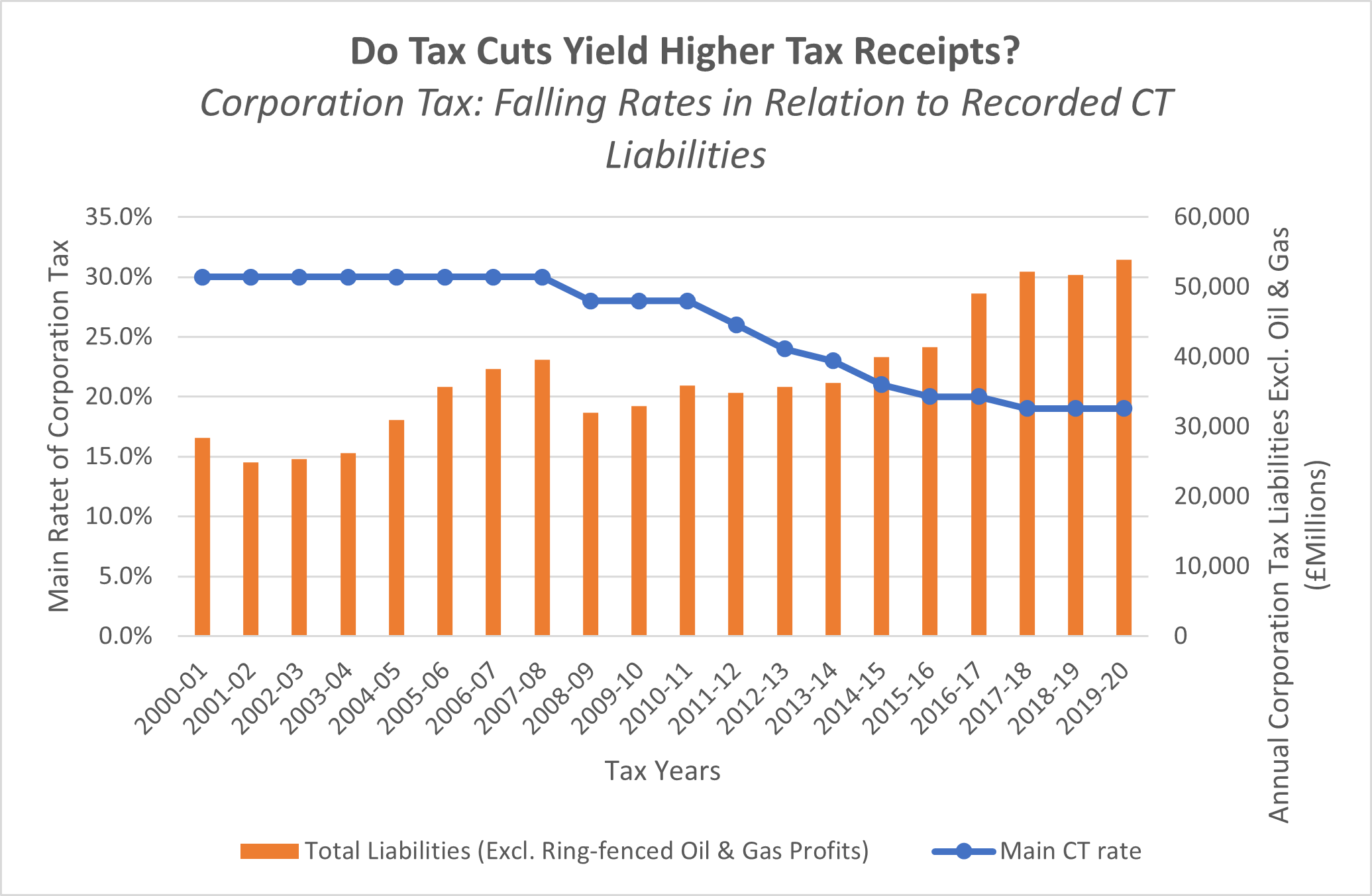

Ct Tax Rates 2024 Dorie Geralda, 100% of the income tax. Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2024, including reduced.

Ct Tax Rates 2024 Reyna Clemmie, On january 1, 2024, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat tax with a rate of 5.49 percent. Specifically, the 3% rate on the first $10,000 earned by unmarried individuals and the first $20,000 earned by married individuals filing jointly or earned by a person who files a.

New Ct Rates 2024 Gerrie Consuela, The following calculators are available from myconnect. On january 1, 2024, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat tax with a rate of 5.49 percent.

Ct Tax Calculator 2024 Elli Phyllys, Personal income tax rates and thresholds. State website search bar for ct.gov.

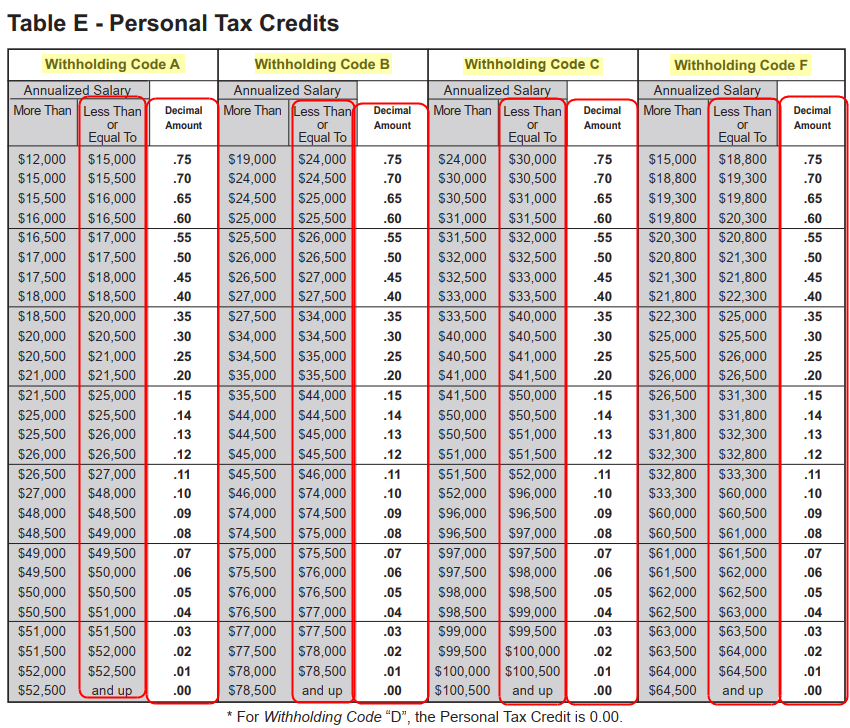

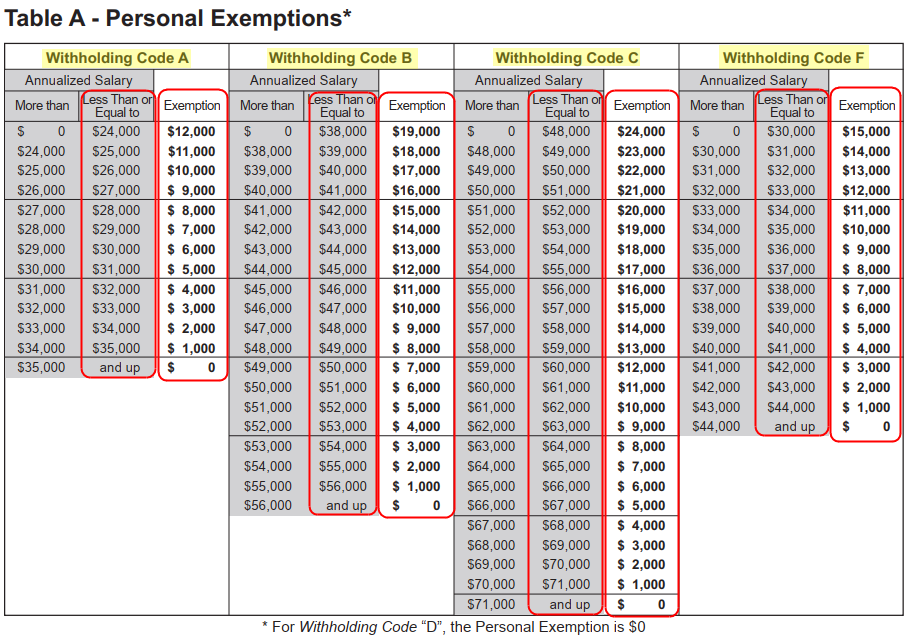

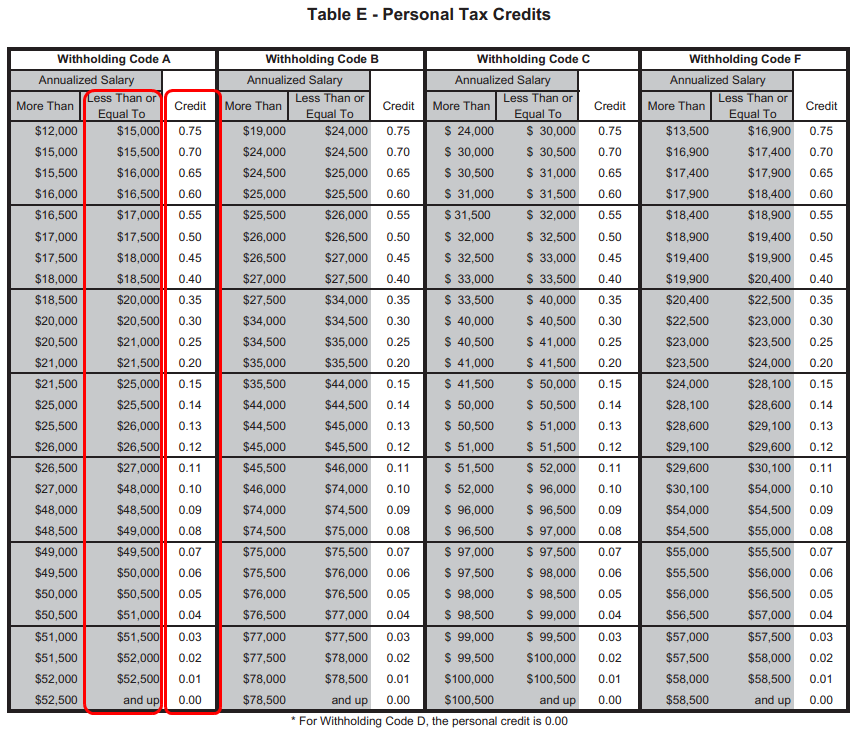

Ct Sales Tax Chart 20192024 Form Fill Out and Sign Printable PDF, According to tables released monday by the governor's office, the savings kick in at $120 for single filers making $30,500 in annual adjusted gross income, whose. Specifically, the 3% rate on the first $10,000 earned by unmarried individuals and the first $20,000 earned by married individuals filing jointly or earned by a person who files a.

Tsc ct Fill out & sign online DocHub, According to tables released monday by the governor's office, the savings kick in at $120 for single filers making $30,500 in annual adjusted gross income, whose. Changes to connecticut’s income tax that take effect jan.

PowerChurch Software Church Management Software for Today's Growing, The connecticut state tax calculator (cts tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. Personal income tax rates and thresholds.

PowerChurch Software Church Management Software for Today's Growing, Specifically, the 3% rate on the first $10,000 earned by unmarried individuals and the first $20,000 earned by married individuals filing jointly or earned by a person who files a. Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2024, including reduced.

Connecticut State Tax Withholding Form 2022, The connecticut tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in connecticut, the. The 5% tax rate will be lowered to 4.5%, and the 3% tax rate will be lowered to 2% starting in the 2024 tax year.

Irs New Tax Brackets 2024 Elene Hedvige, The connecticut state budget (hb 6941) approved by governor ned lamont on june 12, 2023, includes reductions to the state's personal income rates for middle. Connecticut residents state income tax tables for single filers in 2024.

Connecticut governor ned lamont has announced that three income tax measures will take effect at the start of 2024, including reduced.

The connecticut state tax calculator (cts tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Aaai 2024 Submission Date Foundation models are quickly emerging as powerful tools to solve a variety of biomedical challenges, such....

Best Grills 2024 Under $500 We reviewed their features, performance, and build quality to make sure. The gas grills in...

2024 Toyota Highlander Pics Take a look at highlander images and picture yourself behind the wheel of this stylish suv....

Eid 2024 Dates Usa Moonset on june 7 is 11.06pm in london. Eid ul fitr, celebrated as 'meethi eid', marks...

Euro 2024 Uk Tv Schedule Euro 2024 news | euro 2024 stadiums | euro 2024 hub. Friday, june 14 will...

Recall On 2024 Toyota Tacoma Toyota issued a recall for about 381,000 tacoma trucks built in the 2022 and 2023...